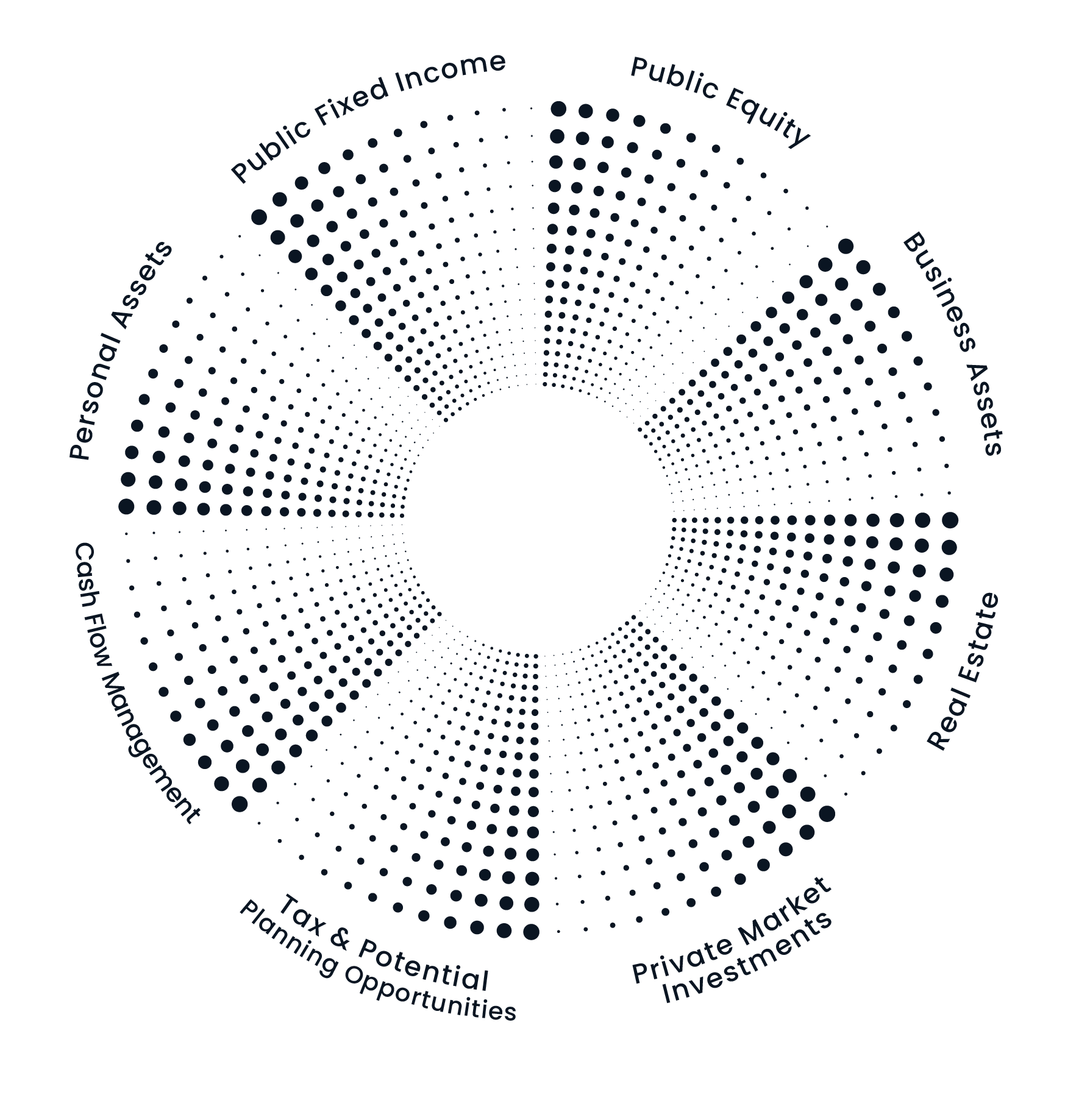

We continually evaluate new investment opportunities across public and private markets, with a focus on enhancing after-tax outcomes and aligning with long-term planning goals.

Our investment sourcing process is rigorous and intentional, centered on quality, fit, and purpose – not trend chasing. From private credit to institutional real estate and tax aware strategies, we seek ideas that bring real value to the families we serve.

Our process begins with planning. We believe great investment decisions are grounded in context. We design portfolios around each client’s unique goals, applying a disciplined framework to sourcing, structuring, and managing both public and private market opportunities.

The result: strategies that emphasize tax efficiency, long-term clarity, and consistent, risk-aware outcomes.

Through strategic relationships and platform partnerships, we provide clients with access to institutional-caliber private investments and opportunities often unavailable through traditional channels.

By leveraging pooled capital and thoughtful due diligence, we aim to negotiate favorable terms, reduce fees, and align each opportunity with the broader goals of your financial plan.

As fiduciaries, we are legally and ethically bound to act in your best interest. We believe that’s just the starting point.

At OC Partners, we go further: delivering advice free from product conflicts, proactively managing tax implications, and ensuring full transparency in every recommendation we make. Our planning-led approach keeps your goals at the center, always. Every strategy we implement reflects one simple priority: doing what’s right for you.